Summary

- US Foods Holding Corp. is a leading food service distributor in the United States.

- The company is facing economic headwinds as slowing consumption will hit demand for food.

- The company has done moderately well to achieve efficiencies and expand into sustainable foods but leaves a lot to be desired.

- The company’s finances and profitability profile leaves a lot to be desired. The company has a NI margin of 1% and is seemingly overleveraged, with a larger capex spend forecast in the NTM.

- Our valuation suggests the business is trading at about fair value and so rate the stock a hold.

Company Description:

US Foods Holding Corp. (NYSE:USFD) is a leading food service distributor in the United States, providing fresh, frozen, and dry food and non-food products to a wide range of customers.

Its client base includes a range of establishments, including restaurants, hospitals, nursing homes, hotels, and retail locations, among others. US Foods operates distribution facilities and cash and carries.

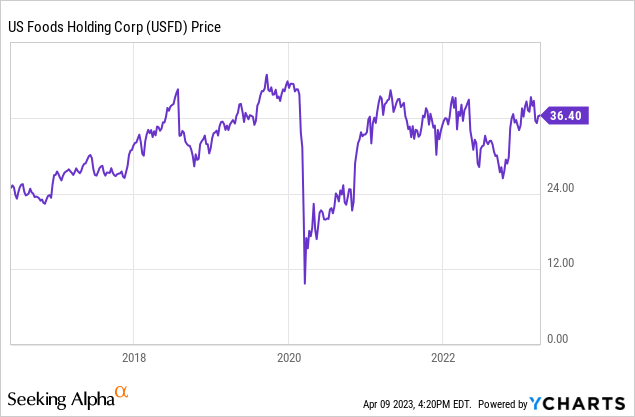

Share Price:

US Food’s share price performance has been uneventful in the decade, with a monumental decline as a result of the COVID-19 pandemic. This is logical as based on the company’s clients, it was expected that demand will significantly decline. Since then, the business has struggled to recover to its pre-COVID level, this is despite an improvement in financial performance.

Investment Thesis:

Assuming we do not experience another pandemic, the food industry in the US should remain incredibly robust. This is an attractive trait in difficult economic conditions as defensive/value stocks generally outperform the market.

Our objective is to assess whether US Foods represents an attractive investment proposition in today’s market. This will involve consideration of the current food services industry, what the growth prospects look like, how the current economic conditions will impact the business, and what the financial profile looks like following a blockbuster FY22. We will look to conclude with a valuation of the business relative to a similar business, with the view to assessing if there is any upside.

Financial Performance:

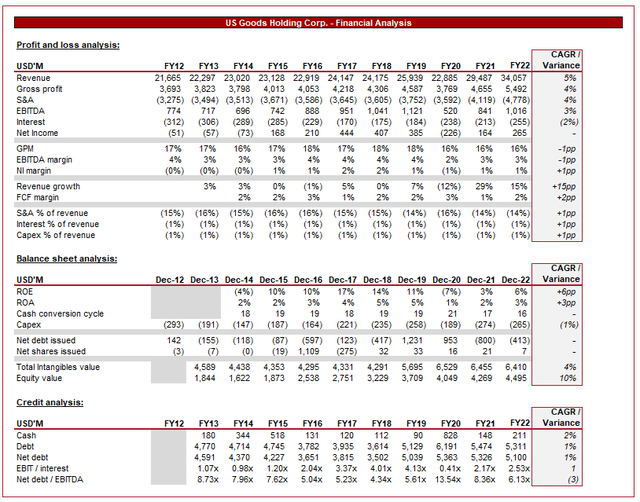

US Foods has had an impressive decade, growing across the board, although has seen bouts of loss-making.

Revenue has grown at a CAGR of 5%, driven by increased market share in key target segments, including restaurants. Further, the business has expanded its geographical reach, opening additional CHEF’STOREs, with more planned in 2023.

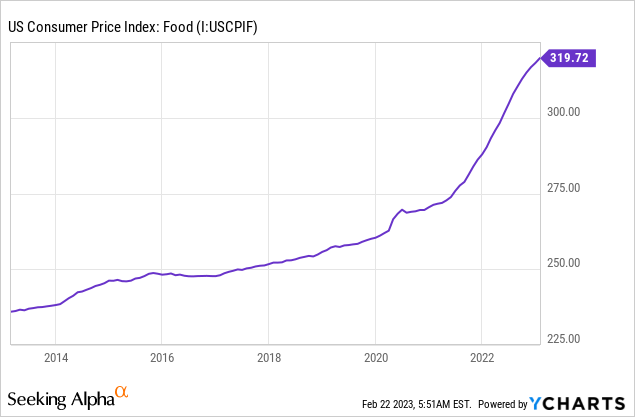

GPM has remained relatively flat during the historical period, ticking down in the most recent periods. This is driven by a change in supply-side economics, contributing to greater costs. As the following graph shows, the price of food has substantially increased, illustrating the effects of rising costs. With this in mind, US Foods has done a good job of passing on cost increases. Revenue looks to have increased by 15% in FY22, but the majority of this is driven by inflation, with total organic volume growth at only 1.7%.

Further, inflationary pressures are felt at an operational level, with EBITDA margin contracting. Given the nature of the services provided, this is driven by transportation costs. Management has done a good job of optimizing its logistics to minimize the impact of this.

Competitive trading conditions mean the business only operates with a net income margin of 1%, which leaves little margin for error and importantly, susceptibility to changing market conditions. The company’s growth profile is attractive but the profitability is not.

The company has seen an incremental decline in capex spending relative to revenue, which suggests the business has been underspending in recent periods. Management is guiding $410-430M in FY23, which looks to partially be driven by a catch-up.

Moving onto the balance sheet, the company’s poor profitability is reflected in its underwhelming ROE, which historically has not exceeded 4%.

Management’s operational improvements are reflected in its CCC and inventory turnover, which have both moved positively. This has assisted with cash management, which is beneficial as the business operates with a low cash balance and net cash in cash.

From a credit perspective, the company does not look overly comfortable. US Foods has a fairly large net debt position relative to EBITDA, at 6.13x. Further, it only has 2.5x coverage of interest payments, leaving the company vulnerable to changes in circumstances. S&P Global currently assigns a BB- credit rating. This is a speculative grade, meaning they are less vulnerable in the near-term but face major ongoing uncertainties to adverse changes in conditions. Management has been slowly deleveraging the business but this is not occurring at a rapid pace.

Economic Considerations:

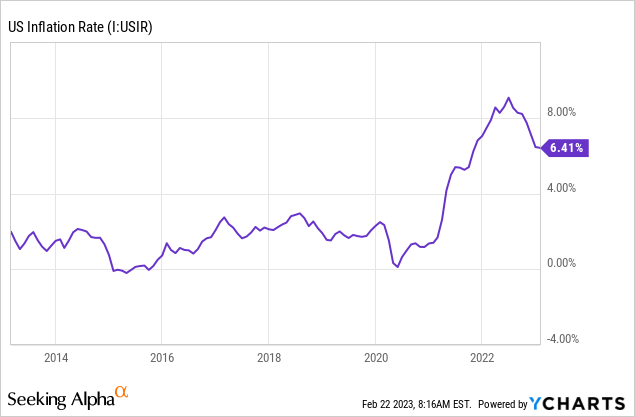

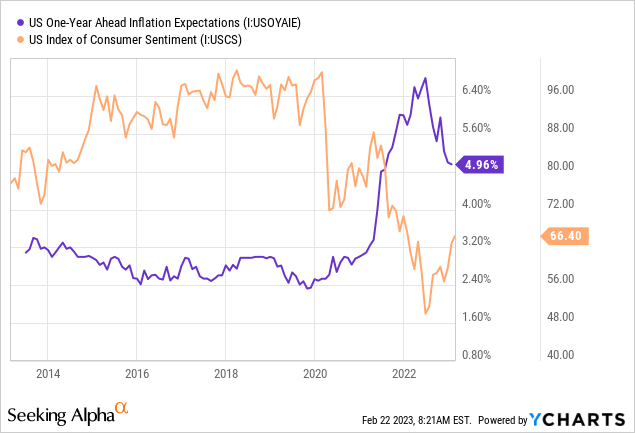

Much of the current changes to US Foods’ financial profile is as a result of changes to economic conditions. We are currently experiencing heightened inflation, driven by supply-side issues following the end of lockdowns. This has remained surprisingly resilient against economic policy, with spending over a year above 5%. This has been a key driving force contributing to slowing demand, with consumers suffering from a reduction in discretionary income.

The impact on US Foods looks to be a net negative. From a downside perspective, there is less demand for food as consumer spending in segments such as restaurants declines. Consumers are far more likely to cook at home and find opportunities to cut back where possible. On the other hand, a portion of this demand must remain inelastic, such as healthcare, as businesses have little choice in most cases. There is of course a portion who will shop around and look for cheaper options. In the case of US Foods, its NI margin declined 0.7% between FY22 and FY19.

Looking ahead, our view is that things will continue to worsen, at least in FY23. The reason for this is that inflation is not declining at the level required, suggesting rates will need to increase further. Looking at inflation expectations, this seems to support our assertion. This will have the impact of increasing borrowing costs further for consumers, as well as businesses. Further, it will increase consumers’ cost of living, potentially pushing the economy over the edge into a recession. Consumer sentiment is at record low levels, with many consumers likely bracing for further struggles.

Healthy Eating:

An interesting trend impacting the food service industry is the increasing demand for healthy and sustainable foods. With greater awareness and media coverage, consumers are more greatly considering the impact of their food choices on both their health and the environment. The research suggests this is driving a structural change in consumption.

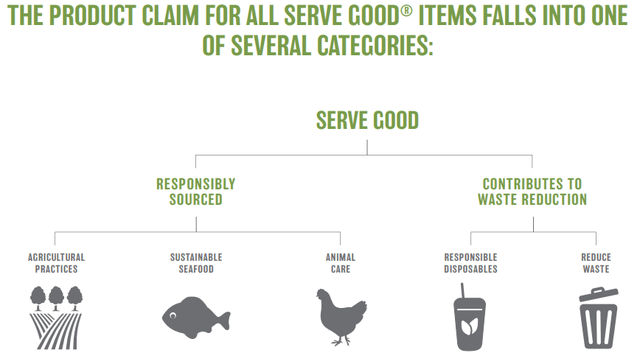

In response, US Foods has expanded into this segment, including expanding its line of organic, locally-sourced, and sustainably grown products, as well as introducing more plant-based and vegetarian options to its menus. This has been part of an overarching line they refer to as “Serve Good”. What we are impressed with here is that this covers a wide range of products and all the key sustainability issues. It is important to remember that economies of scale are key and so building out infrastructure and the supply of a range of products will be highly beneficial long-term if trends continue. This ensures that the company remains at the forefront of sourcing requirements and does not lose potential or current customers because they cannot source their needs.

Outlook:

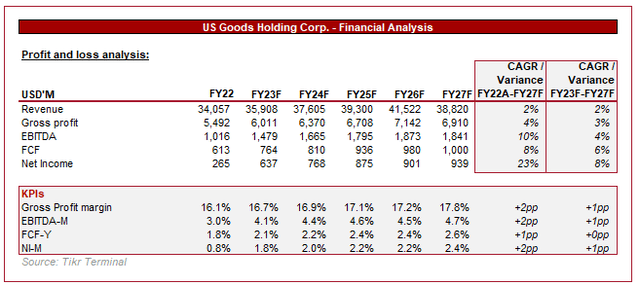

Analysts are forecasting continued incremental growth in revenue, at a CAGR of 2%. This view looks reasonable to us as although things may slow further in FY23, much of this will be recovered in the years subsequent.

Interestingly, analysts are pricing significant GPM and NI gains in the coming years. Management has actively looked to improve operational efficiencies to achieve this for many years, yet has only made minor improvements when looking across an extended period. Further deleveraging will likely contribute to NI improvements but this does not explain GPM. Our view is that this looks optimistic, with the EBITDA margin change looking more reasonable.

Based on the factors we have assessed in this paper, FY23 may be a flat year, potentially even a decline compared to FY22. Analysts are currently forecasting an impressive uptick in net income but it is difficult to see how this materializes. Further, if things do financially weaken, it could pose a threat to the company’s deleveraging efforts when you factor in the additional capex spend required.

Relative Performance:

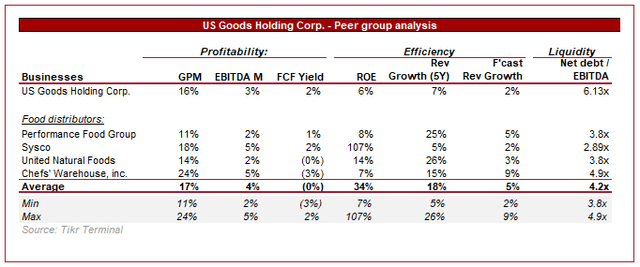

Presented above is a cohort of food distribution companies operating primarily in the US. What we observe is a general uniformity between the companies’ financial profiles.

US Foods performs slightly better than its peers, generating marginally better FCF while being slightly lower in the other margins. Given that the business has a far larger Capex cycle incoming, this will likely result in the company being an underperformer in the coming year.

Moving on to growth, the business equally underperforms and does so using greater leverage. United Natural Foods (UNFI) and Performance Food Group (PFGC) have done well to grow in the natural foods segment, an area US Foods could perform better in.

Valuation

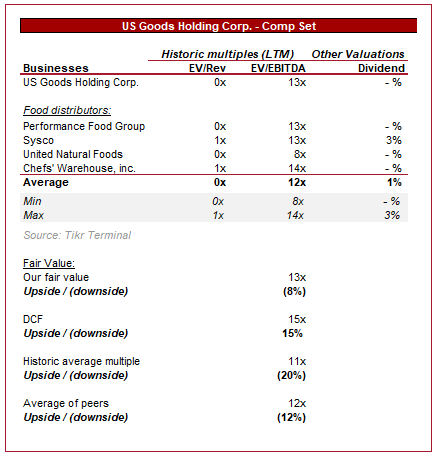

Similar to their financial performance, the companies are generally uniform, trading at similar valuations.

Our view is that US Foods should be trading at a slight discount to the average of the peers, excluding UNF. UNF is trading at an unusually large discount to its peers, representing an outlier. With this removed and a 10% discount applied, we derive a valuation of 13x and an upside of -8%.

As a secondary check, we have conducted a DCF valuation. Our key assumptions are:

- Revenue growth in line with analyst forecast, but marginally lower FCF conversion. Our FY23F view is far more conservative upon the assumption that things weaken further.

- A discount rate of 8% and a perpetual growth rate of 2.25%.

- An exit multiple of 10x, reflecting a lower valuation attached to lower long-term growth.

Based on these assumptions, we derive an upside of 15%.

This represents a large target price, suggesting the value of the business is in its long-term cash flows. Unfortunately, we do not see any catalysts ahead which would allow the business to be priced in line with its future cash flows.

Final Thoughts:

The US food industry is a highly attractive investment option on paper, given it is essentially a bet on long-term economic prosperity. The reality, however, is low margins and uninspiring growth. There are very few trends and structural changes to exploit, leaving the businesses to grow in line with inflation/population growth. In the short-term, we see economic headwinds, with slowing consumption impacting demand from Restaurants. Our valuation suggests long-term value at US Foods’ current valuation but we struggle to rate the stock a buy on unattractive fundamentals and lack of catalysts. Given the margin for error and an average of the valuation we have conducted, the stock looks appropriately valued.

Source : Seeking Alpha